Solar 33 Whitepaper

🌄 Introduction

Solar 33 is a pioneering platform revolutionizing solar energy investment in New Zealand. We enable global investors to purchase fractional Solar Units in real operational solar farms, starting with as little as $100 USD.

Investors receive proportional monthly revenue from electricity sold to the grid, potentially earning up to 180% APY while contributing to New Zealand's renewable energy goals.

By leveraging blockchain for transparency and automation, Solar 33 removes traditional barriers, making high-yield clean energy investments accessible to everyone.

🌱 Mission & Vision

Solar 33's mission is to democratize access to sustainable solar investments, delivering attractive passive income while accelerating the global shift to clean energy.

We envision a world where anyone can own a piece of renewable infrastructure, benefiting financially and environmentally from New Zealand's abundant sunlight.

By focusing on unused land and efficient operations, we create win-win outcomes: high returns for investors and meaningful carbon reduction for the planet.

💡 How It Works

1. Investors buy Solar Units via our platform (minimum $100 USD).

2. Each unit represents fractional ownership in physical solar panels on operational farms.

3. Farms generate electricity sold to the New Zealand grid.

4. Revenue is automatically distributed monthly as passive income via blockchain smart contracts.

5. No management required – we handle site selection, construction, maintenance, and sales.

🌿 Solar Farms

Solar 33 develops farms on carefully selected barren or low-productivity land with optimal sunlight exposure.

Sites are chosen for high irradiation, grid proximity, and minimal ecological impact – often areas unsuitable for farming or habitat.

Current and planned farms leverage New Zealand's world-class solar resources in regions like the upper North Island and South Island valleys.

🏞️ Sustainability

Every Solar 33 investment directly supports New Zealand's renewable targets (90% by 2025, 100% by 2035).

By utilizing non-arable land, we avoid competition with agriculture while reducing carbon emissions equivalent to thousands of trees planted.

Our projects contribute to biodiversity through screening planting and responsible land management practices.

📊 Investment Overview

• Minimum investment: $100 USD

• Global participation welcome

• Blockchain-secured transparency

• Monthly passive income distributions

• Potential for capital appreciation as farms scale

📈 ROI & Returns

Solar 33 targets exceptional returns through efficient operations and New Zealand's strong solar resource.

Investors can achieve up to 180% APY based on energy production and electricity pricing.

Global benchmarks show solar farm ROI typically 10-20%, with Solar 33's fractional model enhancing accessibility and yield potential.

💰 Revenue Model

Primary revenue from electricity sales to the grid under long-term agreements or spot market.

Additional streams may include Renewable Energy Certificates (RECs) and carbon credits.

After operational costs (maintenance ~1-2%, insurance), net revenue is distributed proportionally to unit holders monthly.

🏦 Financial Structure

Projects financed through a mix of equity (investor units) and potential non-recourse debt.

Cash waterfall prioritizes O&M, debt service (if applicable), reserves, then investor distributions.

Blockchain ensures auditable, automated payouts with minimal overhead.

🔮 Financial Projections

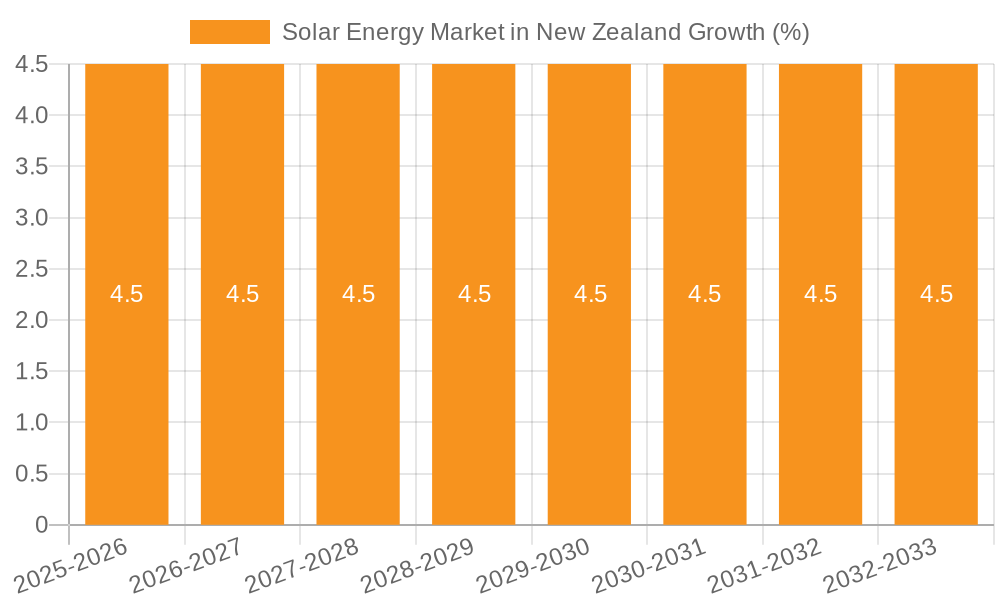

Aligned with NZ solar growth: capacity from ~792 MW (2025) projected to multi-GW by 2030.

Electricity generation forecast to grow at 6.55% CAGR, supporting stable revenue scaling.

Investor returns benefit from falling costs and rising demand.

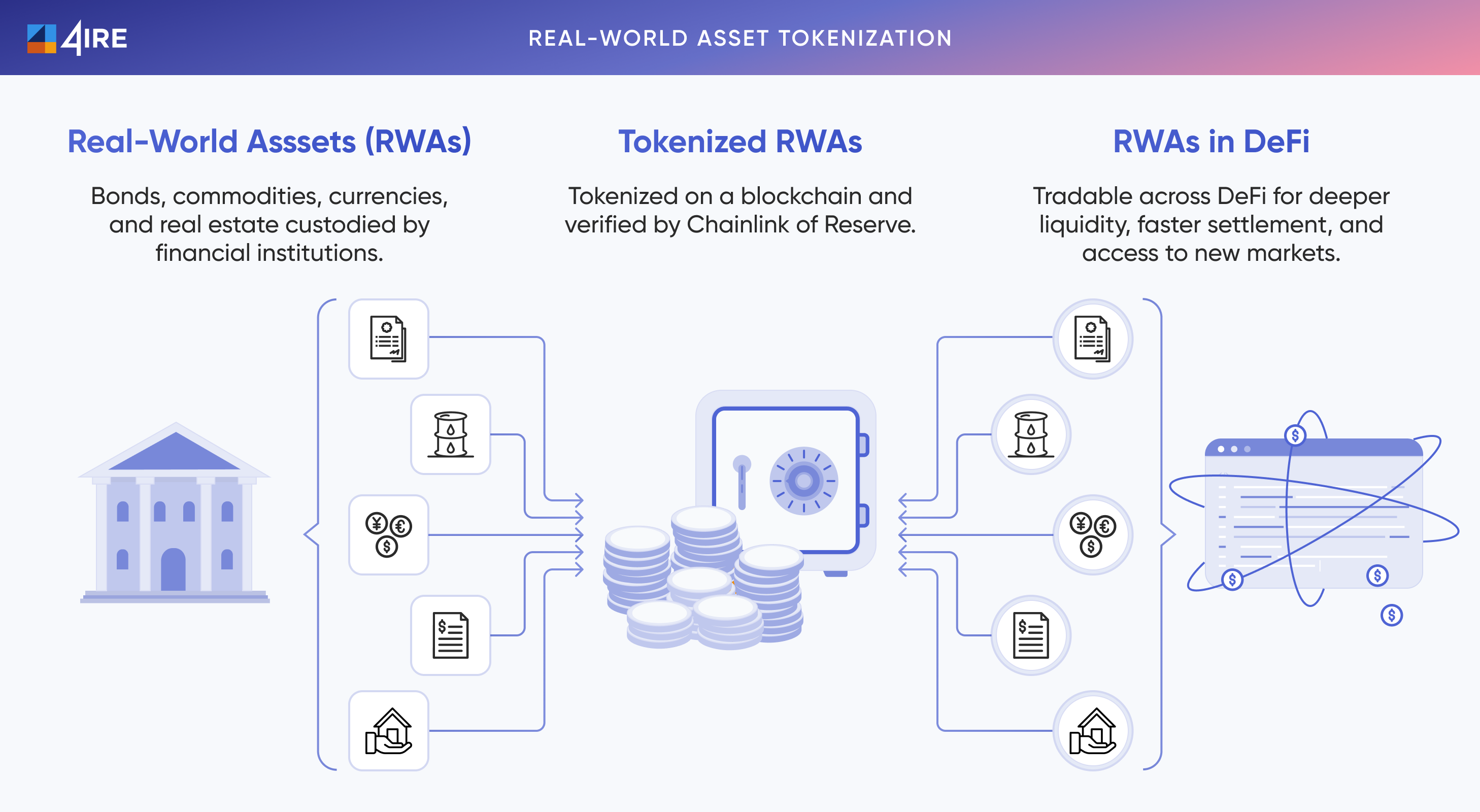

🔗 Tokenization & Blockchain

Solar Units are tokenized as Real World Assets (RWAs) on blockchain for fractional ownership, transparency, and seamless transfers.

Smart contracts automate revenue distribution and governance.

📉 Market Analysis

New Zealand's solar market is booming: from 447 MW (2024) to projected gigawatt-scale by 2030.

Government targets 90% renewables by 2025 drive utility-scale growth.

Rising electricity demand (35-82% by 2050) creates strong pricing support.

⚠️ Risks & Mitigations

• Weather variability: Mitigated by site diversification and insurance.

• Regulatory changes: Compliant structure with experienced legal oversight.

• Grid constraints: Sites selected for strong connection access.

• Technology degradation: Conservative modeling with warranties.

⚖️ Legal Structure

Projects comply with New Zealand's Resource Management Act (RMA) and Overseas Investment Act where applicable.

Entity structured for investor protection, with transparent governance.

Resource consents secured for farm development; blockchain elements align with existing financial regulations.

👥 Team & Partners

Experienced leadership in New Zealand renewables, solar development, and blockchain technology.

Strategic partnerships with local land owners, grid operators, and international tech providers.

🛤️ Roadmap

• 2025: Initial farms operational, first investor payouts

• 2026: Scale to multiple sites, enhance blockchain features

• 2027+: Nationwide expansion, secondary market for units

❓ FAQ

How are payouts calculated? Proportional to units owned and farm production.

Is my investment secure? Backed by physical assets and blockchain transparency.

Can I sell my units? Planned secondary trading in future phases.

What currency are payouts in? USD stablecoin or fiat equivalent.

Are there any fees? Low operational fees deducted before distribution.